Trade ETFs/EXCHANGE TRADED FUNDS

Leverage instruments that track a particular index, sector, commodity or other asset, ideal for those just beginning their investment journey

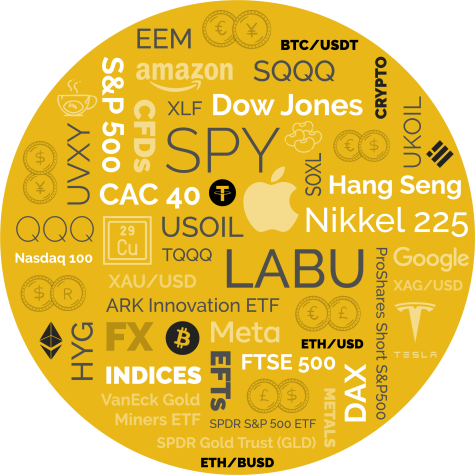

Unmatched access to the fast-growing ETF market

ETFs, or Exchange Traded Funds, are a relatively new and very popular arrival on the trading scene. The popularity of ETFs as a means to gain efficient access to an underlying asset or market is reflected in its astonishing £10+ trillion market share (2021).

The most popular ETFs track major stock indices like the FTSE All Share and S&P500. ETFs aren’t always made up of ‘baskets’ of assets, however, they can also track the performance of a single stock.

ETFs are a ‘passive’ trading opportunity for clients just setting out on their investment journey who want fast, low-cost and simple access to companies (stocks), or a whole sector, without having to stock-pick or buy and sell multiple stocks. ETFs can also be used to invest in commodities including gold, oil and debt (fixed income) instruments.

Why trade ETFs?

- Portfolio diversification – Diversification across asset classes is always sound investment practice. ETFs are an efficient way to access and manage multi-markets exposure.

- Fast, cost-effective access to markets, sectors and specific asset classes – ETFs are liquid, price-transparent, exchange-traded instruments. You can buy and sell them at any time.